MAF

Multiple Asset Fund

.jpg)

Johara Farhadieh

Chief Investment Officer

Frank Holsteen

Managing Director, Investment Management

Hoa Quach, CFA

Director, Public Markets

| Fund Snapshot | |

| Inception | May 1, 2002 |

| Exp. Ratio | 0.55% for 2025 |

| Benchmark | MAF Benchmark |

| Fund Assets | $3,471 Million as of December 31, 2025 |

| Holdings | December 31, 2025 |

| Unit Price History | Wespath Funds Price History |

| For More Information | Investment Funds Description – P Series |

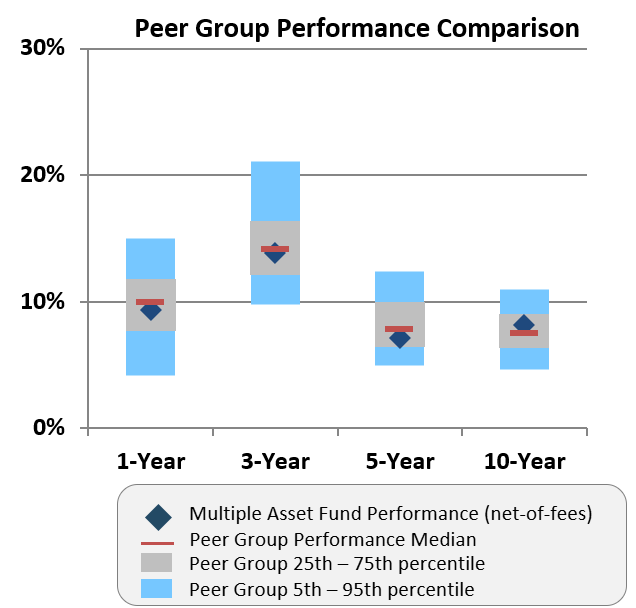

| 3 mo | YTD | 1 yr | 3 yr | 5 yr | 10 yr | |

| Multiple Asset Fund | 1.66% | 14.34% | 14.34% | 11.75% | 4.82% | 8.08% |

| MAF Benchmark | 2.61% | 18.00% | 18.00% | 14.63% | 7.15% | 8.75% |

Multiple Asset Fund vs. Peer Group Universe