USEF

U.S. Equity Fund

Frank Holsteen

Managing Director, Investment Management

Hoa Quach, CFA

Director, Public Markets

Andrew Steedman, CFA

Associate, Public Equities

Amy Bulger

Director, Private Markets

| Fund Snapshot | |

| Inception | December 31, 1997 |

| Exp. Ratio | 0.53% for 2025 |

| Benchmark | Russell 3000™ Index |

| Fund Assets | $5,291 Million as of December 31, 2025 |

| Holdings | November 30, 2025 and December 31, 2025 |

| Unit Price History | September 30, 2025 and October 31, 2025 - Excel |

| For More Information | Investment Funds Description – P Series |

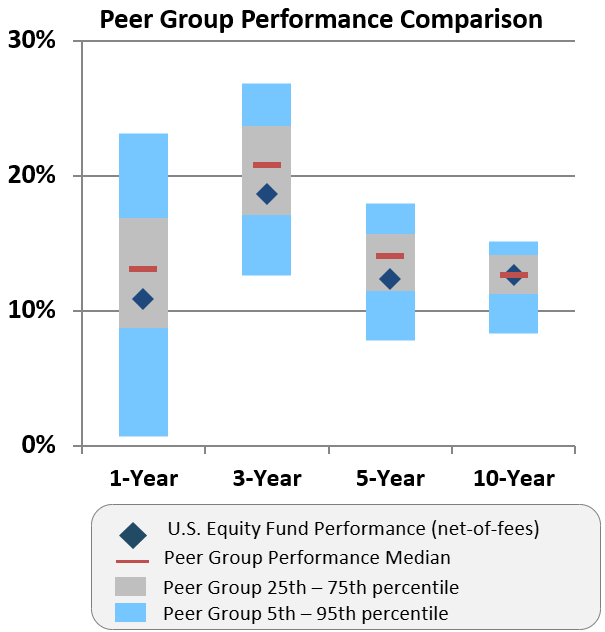

| 3 mo | YTD | 1 yr | 3 yr | 5 yr | 10 yr | |

| U.S. Equity Fund | 1.20% | 10.73% | 10.73% | 16.46% | 8.87% | 12.19% |

| USEF Benchmark | 2.40% | 17.15% | 17.15% | 22.25% | 13.15% | 14.29% |

U.S. Equity Fund vs. Peer Group Universe