IEF

International Equity Fund

Frank Holsteen

Managing Director, Investment Management

Hoa Quach, CFA

Director, Public Markets

Virgilio Calahong, CAIA

Manager, Public Equities

Amy Bulger

Director, Private Markets

| Fund Snapshot | |

| Inception | December 31, 1997 |

| Exp. Ratio | 0.77% for 2024 |

| Benchmark | Morgan Stanley Capital International All Country World (MSCI ACWI) ex-USA IMI |

| Fund Assets | $3,714 Million as of December 31, 2024 |

| Holdings | March 31, 2025 |

| Unit Price History | Wespath Funds Price History |

| For More Information | Investment Funds Description – P Series |

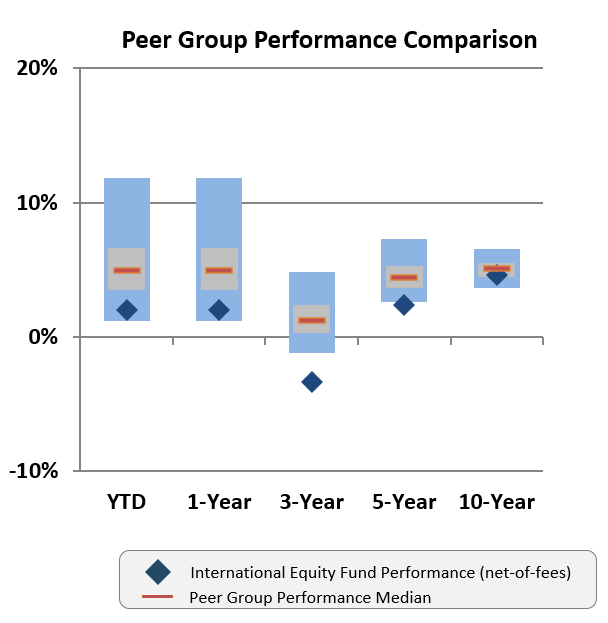

| 3 mo | YTD | 1 yr | 3 yr | 5 yr | 10 yr | |

| International Equity Fund | 11.02% | 14.64% | 14.06% | 9.84% | 7.00% | 5.62% |

| IEF Benchmark | 12.71% | 17.88% | 17.83% | 13.92% | 10.20% | 6.18% |

International Equity Fund vs. Peer Group Universe