IPF

Inflation Protection Fund

Frank Holsteen

Managing Director, Investment Management

Hoa Quach, CFA

Director, Public Markets

Connie Christian, CFA

Manager, Fixed Income

| Fund Snapshot | |

| Inception | January 5, 2004 |

| Exp. Ratio | 0.44% for 2025 |

| Benchmark | IPF Benchmark |

| Fund Assets | $1,253 Million as of December 31, 2025 |

| Holdings | December 31, 2025 |

| Unit Price History | Wespath Funds Price History |

| For More Information | Investment Funds Description – P Series |

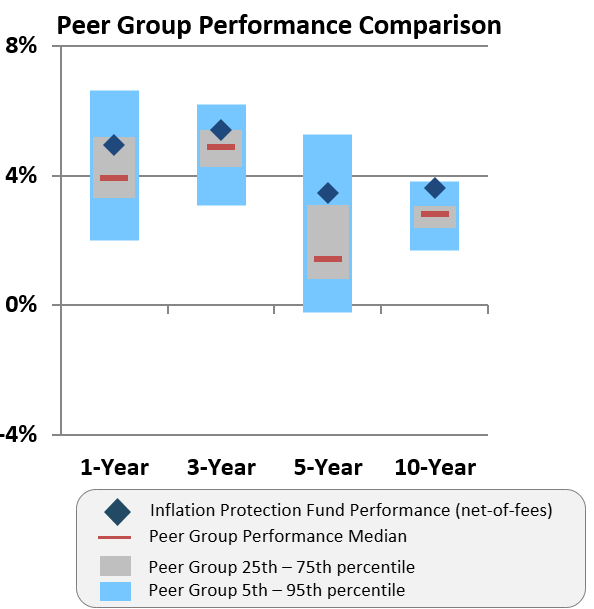

| 3 mo | YTD | 1 yr | 3 yr | 5 yr | 10 yr | |

| Inflation Protection Fund | 1.08% | 8.74% | 8.74% | 4.88% | 2.97% | 3.91% |

| IPF Benchmark | 0.70% | 7.89% | 7.89% | 4.43% | 1.29% | 3.60% |

Inflation Protection Fund vs. Peer Group Universe