When Wespath invests in strategies that seek to intentionally help generate measurable positive change, we categorize these as “impact investments.” Wespath’s longest running impact investment program—the PSP Lending Program—has been operating since 1990 and has proven that positive impact can be achieved while generating market-rate returns1 and fulfilling our fiduciary duty.

The PSP Lending Program works to promote affordable housing and community development for underserved areas in the U.S. by investing in loans generated by qualified lending partners. Internationally, the program has supported lending opportunities that provide financing for small businesses and entrepreneurs in developing countries.

We are pleased to highlight that, since its launch in 1990, the PSP Lending Program has invested over $2.1 billion in the following areas:

- $1.9 billion+ in U.S. affordable housing, creating or preserving over 52,000 units with investments in all 50 states

- $81 million in community development projects

- $83 million+ in global microfinance investments across 4 continents

The PSP Lending Program has invested in properties in all 50 U.S. states. Check out our highlights and property map page to learn more about the program and find a PSP property near you.

Affordable Housing

There is a clear need for affordable housing developments in the United States. According to the National Low-Income Housing Coalition, there is a shortfall of over 7 million affordable housing units available to rent for extremely low-income renters—defined generally as renters with household incomes at or below the federal poverty level, or at 30% of the median income of their area.

The PSP Lending Program seeks to help address the affordable housing gap by investing in properties benefiting individuals and families earning less than the area’s median income. Certain properties focus on supporting higher risk disadvantaged communities including individuals with special needs, seniors and veterans by offering additional services designed for these residents on-site.

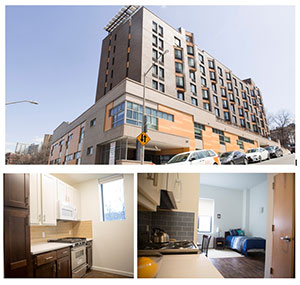

Clark-Estes Apartments: Affordable Housing with a Focus on Resident WellnessWespath invested in a loan for the Clark-Estes Apartments, a 54-unit affordable housing development in a Chicago neighborhood. The property offers residents support services provided by dedicated staff in the areas of job readiness, health, wellness and education, with a special focus on mental health. |

Community Development

The PSP Lending Program also invests in facilities that service low- and moderate-income individuals, including transitional shelters for the homeless and healthcare centers.

237 Landing: Helping Men Transition Out of HomelessnessWespath invested in a loan providing financing for 237 Landing, a 200-bed transitional shelter for homeless men in Bronx, New York. The shelter provides independent living training, food service, transportation and counseling. The operator of the shelter also provides employment counseling and training to residents. |

Image Source: Bowery Residents’ Committee |

Microfinance

The third strategy of the PSP Lending Program focuses on investing in institutions that provide microfinance loans to individuals in developing regions—including Latin America, Eastern Europe, Southeast Asia and Africa—who have little or no access to traditional financial services. These programs aim to help entrepreneurs and business owners from developing countries to grow their enterprises through access to affordable financial services that otherwise would not be available to them.

Shared Interest: Building Small Business to Provide a Path Out of PovertyThrough Shared Interest, loans are made to entrepreneurial borrowers like Zanele, a member of a fruit-growing cooperative in Cape Town, South Africa. |

We rely on a network of intermediary partners—primarily not-for-profit organizations that focus on providing credit and financial services to underserved markets and populations—that serve as key contributors to the financial success of the PSP Lending Program. These organizations provide initial project due diligence, underwriting and ongoing servicing along with asset and loan management services. We evaluate the lending opportunities presented to us and provide a source of capital.

Most PSP Lending Program financed properties are supported by the Low-Income Housing Tax Credit (LIHTC) program. The LIHTC program is the federal government’s primary tool for supporting the development and preservation of affordable housing across the country. To learn more about the LIHTC program, check out our Investment Insights blog. More information about the loan characteristics for many of our investments can be found on our PSP Lending Program Overview brochure.