Updated: Should Investors Be Worried About the Debt Ceiling Debate?

By Joe Halwax, CAIA, CIMA

Managing Director, Institutional Investment Services

This blog was originally posted on February 24, 2023, and was updated on May 15, 2023.

May 15 Update: Negotiations to raise the U.S. debt ceiling are continuing ahead of the June 1 “X-date,” which is the day Treasury Secretary Janet Yellen has warned that the government’s borrowing limits could be reached. President Joe Biden and House Speaker Kevin McCarthy have scheduled meetings this week to discuss a potential deal. Remember that in 2011 a deal was reached just two days before the “X-date,” so while this can be nerve wracking, we have seen this before. To date, U.S. stocks have not seen much debt ceiling-related pressure. However, uncertainty about the debt limit has begun to create volatility in the U.S. Treasury Bill market. Wespath’s Amy Bulger highlighted this trend in our latest Markets at a Glance video:

Start of Original Blog Post

2023 is still in its early innings, but already two storylines have emerged as potentially the most important headlines of the year: ChatGPT and the U.S. debt ceiling.

ChatGPT is an artificial intelligence chatbot program that launched in November. Capable of providing remarkably comprehensive responses to user prompts, ChatGPT has taken the world by storm, reaching over 100 million users by January. A partnership with Microsoft and integration into the Bing search engine this month almost guarantee that we’ll continue hearing about ChatGPT for a while.

There’s a lot to be said about the rise of AI and the popularity of ChatGPT, but for now I’ll leave it at a “pro tip” from a parent of two teenagers—if you’re worried your kids are doing all their homework through ChatGPT, make them cite their sources. If they’ve got all the answers but can’t show their work, you may have found your reason.

Still, I wanted to have some fun with ChatGPT and figured it could help kick off a discussion on the other major story of the year: the debt ceiling. With a prompt of “What is the U.S. debt ceiling?” here’s how the bot responded:

| “The U.S. debt ceiling is a legal limit set by the federal government on the amount of debt it can incur. It is the maximum amount of money the government is authorized to borrow to meet its financial obligations, including Social Security and Medicare benefits, military salaries, and interest on prior debt. The debt ceiling is periodically increased by Congress as necessary. If the debt ceiling is not raised, the government would be unable to borrow money and would be forced to default on its financial obligations, which would have serious consequences for the economy.” |

Not bad. Let’s dig a little deeper—and also try to answer if the debt ceiling is a cause for concern for investors.

A History of the Debt Ceiling

The existence of the debt ceiling is connected to the U.S. Constitution and the “separation of powers,” wherein Congress authorizes spending while the President and the Treasury Department actually conduct that spending.

As my colleague wrote last year in a detailed history of the U.S. debt ceiling, Congress used to approve every new bond issuance. That worked well until World War I, when increased spending required a more practical solution. Laws were established to allow the Treasury to borrow without explicit Congressional approval under a certain limit, and through the course of a few regulatory tweaks over the decades, the modern “debt ceiling” was established.

This works just fine… until it doesn’t. Continued spending and borrowing means a continued need for Congress to raise the debt ceiling—something it’s done nearly 80 times since 1960. Most of those instances have been uneventful, but recently the debt ceiling has become a sort of “political football” resulting in intense partisan showdowns. This has, of course, created uncertainty and introduced volatility into financial markets.

How Markets React

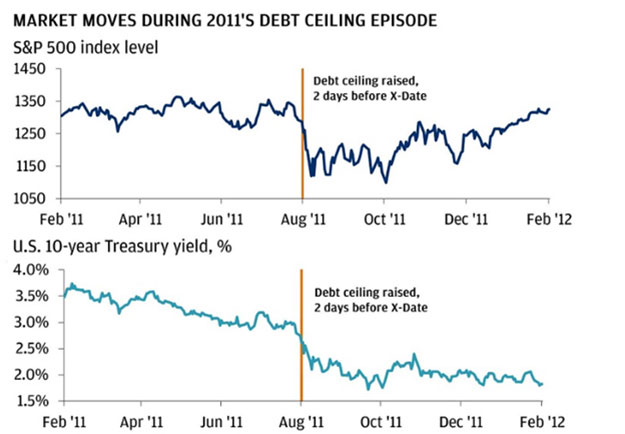

Investors may recall that the debt ceiling did cause market angst back in 2011. As the GOP gained control of Congress, they demanded President Obama negotiate deficit reductions in exchange for an increase in the debt ceiling.

While the ceiling was eventually raised just two days before the Treasury would have exhausted its emergency funding abilities (the “X-Date”), these contentious negotiations were blamed for the most volatile week in the markets since the Great Financial Crisis of 2008. The biggest issue was what followed the debate—S&P downgraded the U.S. credit rating to AA+ from AAA, which caused stocks and the dollar to move sharply lower:

(Source: J.P. Morgan and Bloomberg Finance L.P. data)

Where Are We Today?

The current debt ceiling is $31.4 trillion. To put that in perspective, it’s about 123% of the Gross Domestic Product (GDP) for the United States, which was $25.5 trillion in 2022. From 2016 to 2019 the Debt-to-GDP ratio ran between 105% – 107%, but it has moved sharply higher in the past three years.

Treasury Secretary Janet Yellen warned on January 19 that the U.S. is taking extraordinary measures to maintain our current spending needs. It is estimated that these measures will give the U.S breathing room until June.

New Republican House leader Kevin McCarthy continues to negotiate with President Biden on passing a higher ceiling. The best-case scenario for financial markets is that these talks end quickly and result in some sort of agreement. If the debate drags on into June, we could see some payments delayed and another U.S. debt downgrade. Given the amount of public anger this would bring to both parties, I think it’s very unlikely we get that kind of chaos.

As we approach the June timeframe when emergency funds are reported to run out, we will watch to see if the bond markets are anticipating a default. If there was indeed a strong concern, we would see this reflected in the June U.S. Treasury yields, as investors would avoid holding bonds in that maturity. So far, we are not seeing significant volatility in the three-to-six-month maturities, but if negotiations drag on for several more months without resolution, yields could start to reflect this risk in Q2.

What’s This About a “Trillion-Dollar Coin”…?

You may have heard occasional rumblings about the U.S. Treasury minting a “trillion-dollar coin” to essentially fund itself and get around the debt limit. While I won’t claim to be an expert on the subject, it does appear to be a possible legal loophole. The Treasury does have legal flexibility to mint coins and could conceivably do so.

However, Secretary Yellen already stated in January this this option was not on the table. Plus, the Federal Reserve could always choose not to accept the deposit of the coin. That’s probably good news right now. A trillion-dollar coin would create roughly 5% in new money supply—a move that’d likely be highly inflationary at a time when very-high inflation is just showing signs of cooling. While this potential “solution” to the debt ceiling issue continues to generate public discussion, its actual implementation is very unlikely.

How Is Wespath Positioning for Debt Ceiling Volatility?

As we’ve stated numerous times in our blogs and elsewhere, Wespath is a long-term investor. We try to be conscious of all possible market events, and the potential for esoteric outcomes like another 2011 debt ceiling battle is something we will watch closely.

Nevertheless, we do not intentionally position for one particular outcome from a short-term event like the debt ceiling debate. If there is a disruption, we expect it would be resolved fairly quickly and would respond to any potential dislocation by rebalancing to our target allocations accordingly. Our active asset managers do have the ability to tactically reposition their portfolios and could be more opportunistic if the negotiations cause volatility. But our focus has been—and will continue to be—to ensure our globally diversified portfolios are resilient across market cycles, and to provide our participants and institutional investors with options that balance their unique risk/return considerations.